SEC Whistleblower

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) created a new set of whistleblower protection and reward programs, including for reporting financial irregularity to the Security and Exchange Commission (SEC).

The SEC enforces security laws nationally, to protect financial consumers and investors and maintain a free and fair market. It is estimated that security fraud costs American investors nearly $50 billion every year. The Dodd-Frank Act was enacted in part to create whistleblower programs like those from the False Claims Act and encourage reporting of fraud.

SEC Whistleblower Process

The SEC Whistleblower Reward Program can award individuals who report fraud and misconduct involving security law violations within the United States. The reporting individual need not be in the United States nor a citizen. Anyone, either here or abroad, can report wrongdoing and violations of U.S. security laws.

Individuals who report wrongdoing can choose to remain anonymous. Neither the SEC nor their attorneys will reveal their identify. Whistleblowers who wish to remain anonymous will need an attorney to present the tip on their behalf. To speak with the attorneys at Schneider Wallace, contact us at 1-800-689-0024 or info@schneiderwallace.com.

Examples of financial fraud or schemes that can cause an individual to obtain an award for reporting SEC violations include:

- Auditing and accounting misconduct

- False SEC reports and failure to file reports

- Insider trading

- Pyramid schemes

- Ponzi schemes

- Embezzlement, theft, or misappropriation of funds and securities

- Pump-and-dump schemes or other forms of market manipulation

- Unregistered or fraudulent securities offerings

- Foreign official bribery

- Municipal securities or public pension plan fraud

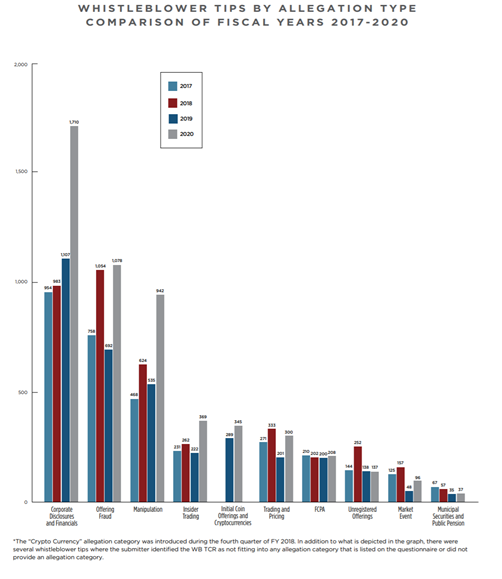

The SEC collects tips for misconduct and maintains their own categorization and labeling system:

- Corporate Disclosures and Financials

- Offering Fraud

- Manipulation

- Insider Trading

- Initial Coin Offerings and Cryptocurrencies (a category since Q4 2018)

- Trading and Pricing

- FCPA

- Unregistered Offerings

- Market Event

- Municipal Securities and Public Pension

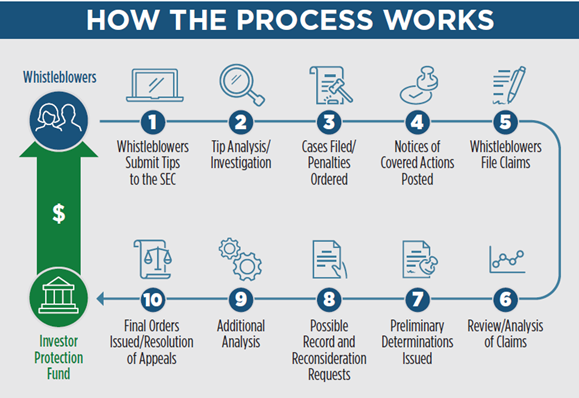

If you are aware of a misconduct or security law violation, you can report to the SEC online, by fax or by mail. This tip will begin the SEC investigation.

After the SEC reviews the information, the SEC can proceed with a case against the defendants. Should the defendant be required to pay a penalty, a whistleblower can file a reward claim. The SEC will review award claims and a preliminary determination of the claims will be provided. After the preliminary determination, a whistleblower or his/her attorney can request reconsideration. Finally, after additional analysis, the final orders of restitution will allow for the SEC to award the whistleblower with an award.

For frequently asked questions, visit our SEC Whistleblower FAQ.

SEC Whistleblower Awards

Awards are given after a tip leads to a successful enforcement action against a defendant. If the SEC determines that the whistleblower provided new information or significant assistance that helped the SEC obtain sanctions, the SEC can award 10-30 percent of the sanctions to the whistleblower.

Sanction funds are placed into the Investor Protection Fund. It is this fund that pays whistleblower awards. The Fund consists solely of sanctions paid by defendants. Funds recovered on behalf of harmed investors are not placed into the fund and are not used for paying whistleblowers. In 2019, the SEC Investor Protection Fund distributed $142 million to whistleblowers.

As the reward is set by the size of the sanction, some SEC awards can be very large. One out of four SEC whistleblower awards are in excess of $5 million, and whistleblowers have been awarded up to $112 million in the past.

To receive an award, a whistleblower need not be an “insider”, or even a citizen of the United States. What is important is the whistleblower is able to identify security fraud or security law violation affecting U.S. investors or affecting U.S. markets.

To read more on awards, visit our SEC Whistleblower awards page.

Related Actions: Under the SEC Whistleblower Program, monetary awards are given after successful “related actions” from original information supplied by a whistleblower. It is possible for one whistleblower to receive multiple awards. A related action is an administrative action or judicial action brought by the Attorney General of the United States, or state Attorney General in a criminal case, or another regulatory authority.

Whistleblowers that are involved with the activity can still receive an award, however it may be reduced by the SEC for participating in the event. It can also be reduced based on the length of time a whistleblower was aware of or participated in an event before reporting. Some job roles, such as an auditor whose job it is to discover violations, are not eligible for awards unless they first report the violation internally or to superiors and no action is taken by the company.

SEC Whistleblower Retaliation

Anyone who reports a potential sanctionable offense to the SEC is covered by the Dodd-Frank anti-retaliation provisions. The Dodd-Frank Act specifically contains expanded protections for whistleblowers including:

Prohibition Against Retaliation: No employer may discharge, demote, suspend, threaten, harass, directly or indirectly, or in any other manner discriminate against, a whistleblower in the terms and conditions of employment because of any lawful act done by the whistleblower.

The SEC 2020 Report notes that maintaining protections for whistleblowers is a high priority for the office, and the SEC Division of Enforcement maintains staff to review potential retaliation and attempted retaliation.

An attorney can keep your SEC submission confidential while also applying to receive an award for your tip.

SEC Whistleblower Report

The most common type of report to the SEC relate to corporate disclosures or financials, followed by those related to offering fraud or market manipulation.

When you file paperwork with the SEC, whether physical or submitted online, you will categorize your tip to the type of alleged violation that occurred. Bitcoin and other coins have a new category as of 2018 called “Initial Coin Offerings and Cryptocurrencies”.

To submit a successful claim to the SEC, you should: establish facts of a material violation; determine your eligibility in advance; act quickly to submit a complete claim and respond quickly to any requests during the claim process; study and know the rules prior to filing with the SEC (or, preferably, hire an attorney knowledgeable in this area of law); and summarize your submission with relevant important facts and documents so the limited staff at the SEC can quickly understand why your submission is important.

The SEC receives over 5,000 submissions each year, and preparing your claim and tip in advance is important to ensure the SEC takes action. Unlike with the False Claims Act, you cannot proceed “qui tam” or on behalf of the government. The SEC must decide to go forward with your tip and seek sanctions against a defendant.

SEC Whistleblower Attorneys

Schneider Wallace represents SEC whistleblowers. To schedule a free and private legal consult with our whistleblower law firm, contact us at 1-800-689-0024 or info@schneiderwallace.com.

We can help make sure you are eligible for an award and can maintain your anonymity during the whistleblower and award process.