Media

The Wage Theft Gap: Misclassification by Job Title and Gender

Across retail stores, hotels, restaurants, and custodial services, a troubling trend persists where job titles are strategically used to deny workers overtime pay. Workers can be assigned titles including “assistant manager,” “team lead,” or “coordinator”, and are made exempt and lose overtime pay despite spending the majority of their time performing the same tasks as hourly employees—stocking shelves, running cash registers, cleaning rooms, or serving customers.

When these workers are labeled as “exempt” from overtime under the Fair Labor Standards Act (FLSA), despite lacking true managerial authority (such as the power to hire, fire, or direct operations with independent judgment), they are often misclassified. This misclassification denies them wages they are legally entitled to, especially overtime. In states such as California and Washington, they are also missing all penalty pay for missed meal breaks and rest breaks.

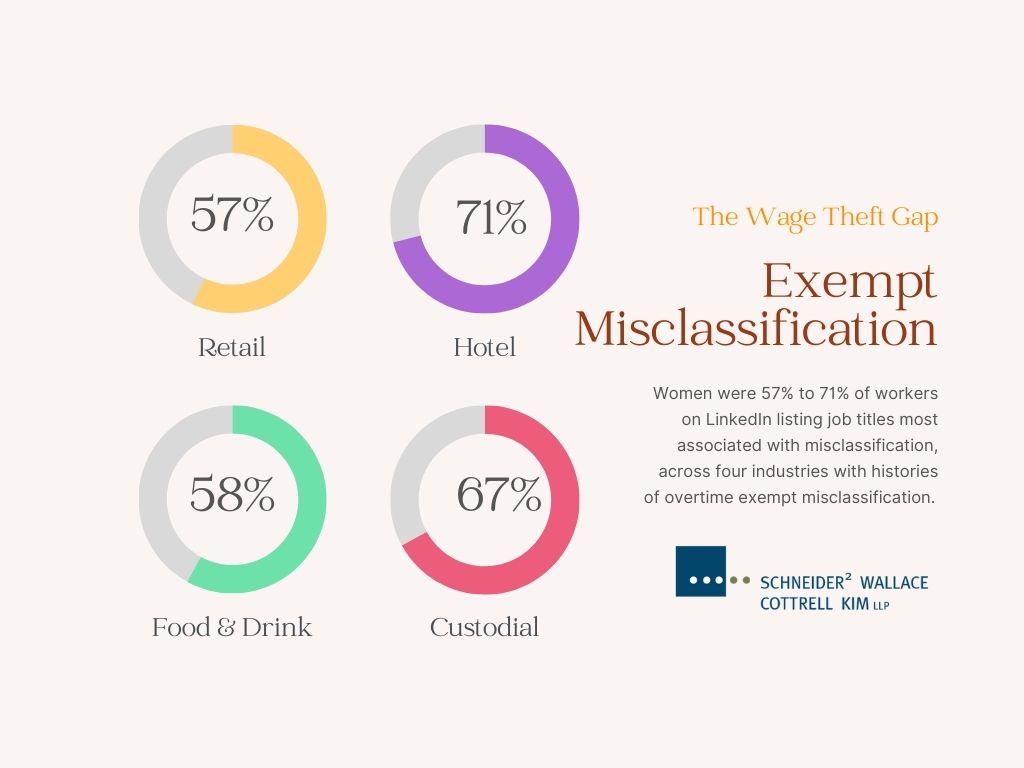

An investigation by Schneider Wallace shows that this practice may not affect all workers equally. Women are significantly more likely than men to hold job titles linked to misclassification when Schneider Wallace reviewed LinkedIn job title data as of May of 2025. This form of wage theft not only undercuts their earnings, but deepens existing gender pay gaps in frontline industries.

Are Women More Likely to Be Misclassified And Denied Overtime With Job Titles Like “Assistant Store Manager”?

Our investigation, using LinkedIn data, found that women in United States were nearly 50% more likely to hold titles frequently associated with wage misclassification. This investigation builds on a recent NBER working paper, updated May 2025, about misclassification by job title.

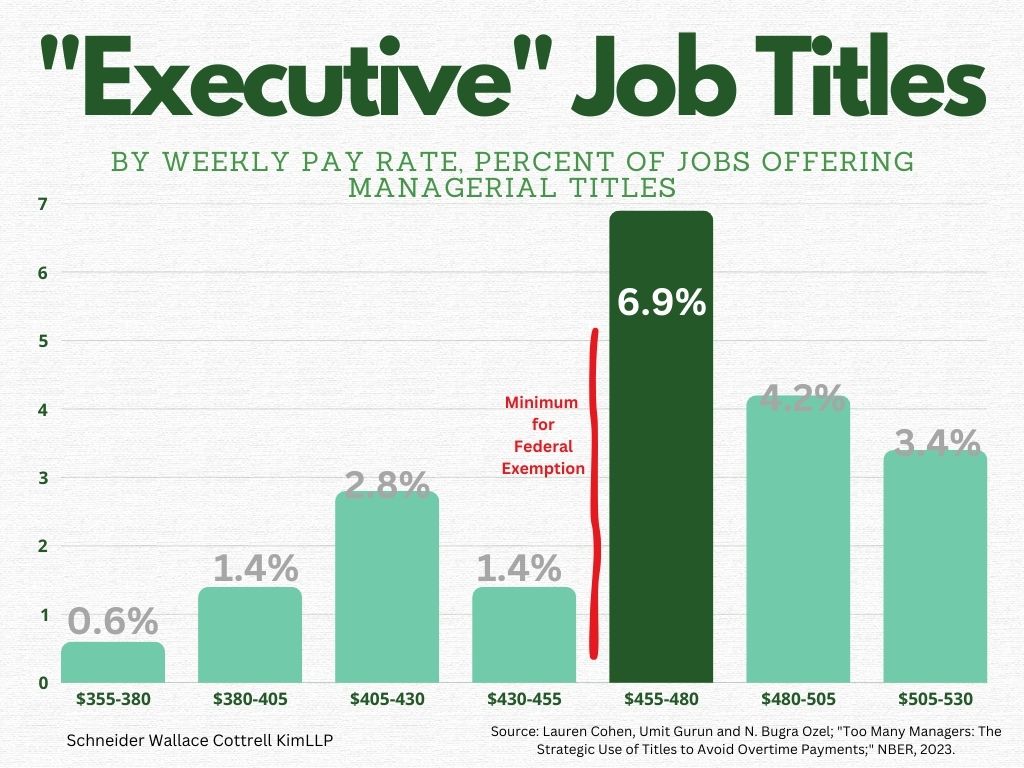

The paper, “Too Many Managers: The Strategic Use of Titles to Avoid Overtime Payments”, investigates the use of job titles referencing managing positions and compares them to wage levels. They find a massive increase in the use of these job titles at pay levels right above each state threshold for exempt status. The implication is clear: Companies use titles such as “assistant manager” to make workers doing non-exempt work exempt, and prevent the pay of overtime. From the abstract:

We find widespread evidence of firms avoiding overtime payments through the strategic use of “managerial” titles. Exploiting a federal mandate in the Fair Labor Standards Act (FLSA), we find an almost five-fold increase in managerial title usage just over the regulatory threshold to avoid overtime payment, including suspect managerial listings such as “Directors of First Impression,” whose jobs are otherwise equivalent (in this case, to a front desk clerk). Overtime avoidance is more pronounced when firms have stronger bargaining power and employees have weaker rights.

Their results were staggering, an expected reduction of 13.5% of overtime pay. They also discovered that the increase in these common misclassified job titles is more pronounced at the minimum salary for exempt in states with lower worker protections.

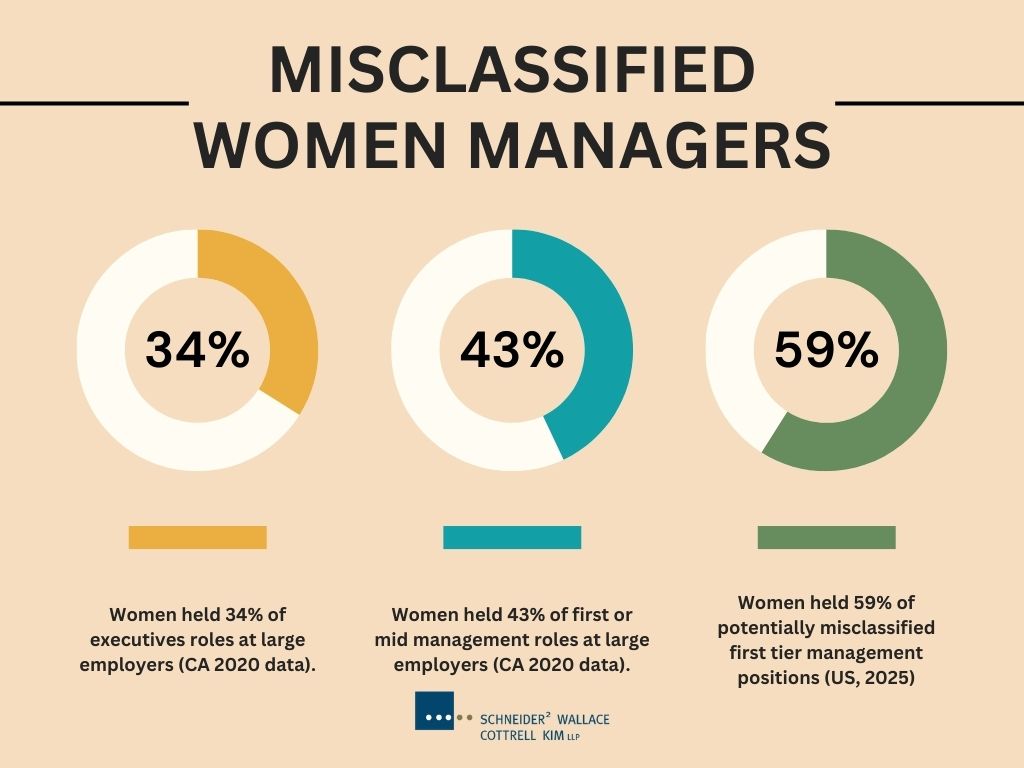

After reviewing 57 job titles such as “Assistant Housekeeping Manager” and “Front Office Team Lead” available in LinkedIn, we discovered 59% of gendered profiles on LinkedIn in the United States were women, 41% were men. Three out of every five workers in these positions are women.

Unpaid Overtime When Misclassified as Exempt

What does it mean to be given a managerial job title but retain most of the original job? It means responsibility, longer hours, without the change in pay you are legally entitled to. In the study, they use an example of the Morgan v Family Dollar Store case, in which 1,400 employees were misclassified as managers despite almost exclusively working non-exempt tasks, resulting in a final verdict and payment of $35 million in back wages and penalties.

Federal Fair Labor Standards Act

The Fair Labor Standards Act (FLSA) has provisions for when administrative workers are exempt from federal rules requiring overtime after 40 hours per week. These include:

- Minimum pay of $684 per week (2023). At the time of the data used for the study, the minimum weekly wage was $455 per week.

- Primary duty (majority of time) is performing office, managerial, or non-manual work directly related to the business operations of the employer or for customers.

- The primary duties above include independent judgement and discretion by the worker, on tasks of significance.

Examples of work that would not count toward a primary exempt duty: Answering the phone, managing office supplies, managing a cash register, stocking shelves, cleaning, organizing material, mail, custodial duties, basic tasks of the business such as the hostess at a restaurant greeting guests or a front desk worker checking in hotel guests, and implanting a checklist task removing independent judgement such as onboarding a new team member via a finalized onboarding guide.

California Administrative Exemption

States including California have additional wage rules, such as overtime for working more than 8 hours per day, and bonus pay for lunches after 5 hours for hourly workers. They have different salary requirements, workers in California as of 2023 must earn $64,480 before they can be classified as exempt.

The California rules on administrative exemption are defined by California law and case law as a worker whose duties:

- Are office or non-manual work directly related to management policies or general business operations of the employer or their customers, and

- Exercise discretion and independent judgement, and

- Regularly assist a bona-fide executive

- Under general supervision only work in a specialized or technical task

- Primarily engage in the above duties (majority of hours)

- Earn 2 times minimum wage for 40 hours over 52 weeks, or $64.480 per year as of 2023.

If you are reading this and feel you may be misclassified, please contact us at any time for a free and private legal consultation. Please reach out to us at 1-800-689-0024 or info@schneiderwallace.com.

Frequently Job Titles For Misclassifying Workers as Exempt

The study focused on identifying job titles associated with using managerial language (“manager”, “coordinator”, “lead”) but for jobs with blurred possible management and worker-level duties. They then focused on four industries noted to have high levels of wage theft:

- Food Services

- Retal

- Hotels and Motels

- Janitorial Services

As the study focused on a dataset covering 2010-2018, and looking for a single figure they could use to divide all job postings by, the study authors focused on states using the federal cutoff for salary exemption as of those years. The cutoff was $455 per week in earnings, or $23,660 per year.

Using data from these states they discovered a massive increase in job titles associated with potential misclassification, a jump of 5 times between those paid just below the threshold ($430-$455) and those paid just above ($455-$480).

From the paper, Appendix F summarizes how they designed the job title search across the four high wage theft industries: https://www.nber.org/papers/w30826

Search of Job Titles Affected:

Using the study investigation as a basis, Schneider Wallace found job titles in LinkedIn that exactly or most closely matched the job title combinations above. LinkedIn data was selected from

Available gender demographic information allowed the data to be seen for male and females holding each job title, and the region could be set to the United States. Below are the job titles included for workers in each of the four main categories:

Custodial:

- Housekeeping Supervisor

- Assistant Housekeeping Manager

- Housekeeping Manager

- Hotel Operations Manager

- Assistant Executive Housekeeper

- Executive Housekeeper

- Assistant Director of Housekeeping

- Director of Housekeeping

- Head Custodian

Retail:

- Assistant Store Manager

- Assistant Store Manager Operations

- Assistant Store Director

- Assistant Shop Manager

- Assistant Retail Manager

- Assistant Retail Sales Manager

- Assistant Manager

- Assistant General Manager

- Store Supervisor

- Store Team Lead

Food Drink:

- Restaurant Supervisor

- Assistant Restaurant Manager

- Cafe Manager

- Assistant Bakery Manager

- Bakery Manager

- Restaurant Shift Supervisor

- Banquet Supervisor

- Assistant Banquet Manager

- Food and Beverage Supervisor

- Duty Manager

- Banquet Manager

- Banquet Captain

- Assistant Director of Food and Beverage

- Assistant Food Service Director

- Assistant Food Beverage Manager

Hotel Reception:

- Front Desk Coordinator

- Front Office Coordinator

- Guest Services Coordinator

- Front Office Team Lead

- Guest Service Team Lead

- Assistant Front Desk Manager

- Assistant Front Office Manager

- Front Office Manager

- Front Office Supervisor

- Reception Manager

- Front Desk Manager

- Front Desk Supervisor

- Reception Supervisor

- Guest Services Manager

- Front of House Manager

- Assistant Guest Services Manager

- Assistant Hotel Manager

- Guest Relations Manager

- Guest Experience Manager

- Executive Team Lead Guest Experience

- Guest Relations Supervisor

- Guest Relations Officer

- Executive Team Lead Guest Experience

Gender Split Of Study Job Titles

After we tallied each category, these are the rates for these job titles in the United States, on LinkedIn, having selected either male or female for gender, as of May 2025:

- Retail: 4 women to 3 men

- Custodial: 2 women to 1 man

- Food: 4 women to 3 men

- Hotel: 5 women to 2 men

- Combined: 3 women to 2 men across all 1 million profiles listed.

In each case the number of women working with these titles exceeded the number of men.

Figures used where those available after the audience tool rounded to nearest 1,000 or 10,000. There are also accounts that did not select male or female as a gender, which are not included in either the male or female totals. With over 1 million accounts in these profiles, including nearly 1 million with a gender to sort, the overall ratio was 3 women to 2 men, or just under 60% women with these job titles.

Executive Secretary and Executive Assistant

Executive Secretary, or Executive Assistant, and variations of Office Managers, while not a category covered by the researchers, is a job title that requires an analysis to understand if they are exempt, both federally and with additional state analysis in states such as California.

This category of job is heavily staffed by women. In California where 2020 large employer data was available, workers across the entire “administrative support” job title spectrum were 70% women, 30% men. Using LinkedIn, 7 job titles with managerial terms but possible non-exempt work had an even higher ratio of 5 women per each man.

If you are an “office manager” but your job is majority consisting of reception duties, office duties such as stocking or buying office supplies, mail, managing employees benefits such as paperwork on new hires medical coverage, custodial work such as stocking the kitchen, and any work without managerial discretion such as following a template for onboarding a new employee, would be generally considered non-exempt labor. If an employee were to engage in these tasks for the majority of their time, and act as a manager overseeing others or managing an executive’s administration needs, they would likely be considered hourly and overtime eligible.

EA and Secretary Job Titles, Gender Divide:

Job Titles in this category found in LinkedIn:

|

Executive Assistant |

|

Executive Secretary |

|

Senior Admin Assistant |

|

Personal Assistant |

|

Executive Admin Assistant |

|

Admin Assistant |

|

Office Manager |

EA and Executive Secretary Job History by Gender: 5 women per 1 man, 5 out of 6.

If we expand beyond the study to include titles such as “Executive Secretary” in the category of Professional Assistants, the ratio becomes nearly 4 to 1 with 80% of women holding these positions across 64 job titles.

While federal and California administrative exemptions would cover many workers in these job titles, workers who primarily engage in the tasks listed above would not be exempt and would be owed overtime. For federal wage laws this includes time and a half for hours above 40. For California workers additional rules would include overtime for more than 8 hours in a day, double time for over 12 hours in a day, an additional hour of pay if lunch is not available or taken after 5 hours each day, and additional bonuses and penalties if not allowed rest breaks as required.

If you are reading this and feel you may be misclassified, please contact us at any time for a free and private legal consultation. Please reach out to us at 1-800-689-0024 or info@schneiderwallace.com.

Equal Pay Protection

The Equal Pay Act of 1963 amended the federal FLSA, adding in protection against wage discrimination based on sex. States such as California have added strong additional state laws adding much of the same protections and include additional protections or penalties for underpayment of one sex.

The Equal Pay Act of the FLSA makes wage discrimination by sex illegal, and includes these forms of competition:

Salary, overtime pay, bonuses, life insurance, vacation, holiday, allowances including cleaning and gas, hotel accommodations, travel expense reimbursement, and benefits. Inequality by sex in any of these categories, such as benefits, even if salaries were similar, would be a violation of the law.

The Equal Pay act requires jobs be compared based on being substantially similar, in skill, effort and responsibility.

Equal Pay in California

California also has their own version of equal pay laws. In 1949, California passed the Equal Pay Act (“EPA”) which prohibited employers from paying employees less than employees of the opposite sex for equal work. The law as originally passed made it difficult for a woman to establish a successful claim, and employers found loopholes which allowed them to continue discriminatory practices.

In 2015, California passed the Fair Pay Act which significantly strengthened equal pay laws. Additional amendments in 2016 and 2017 included prohibiting wage discrimination based on race or ethnicity, as well as protecting against retaliation.

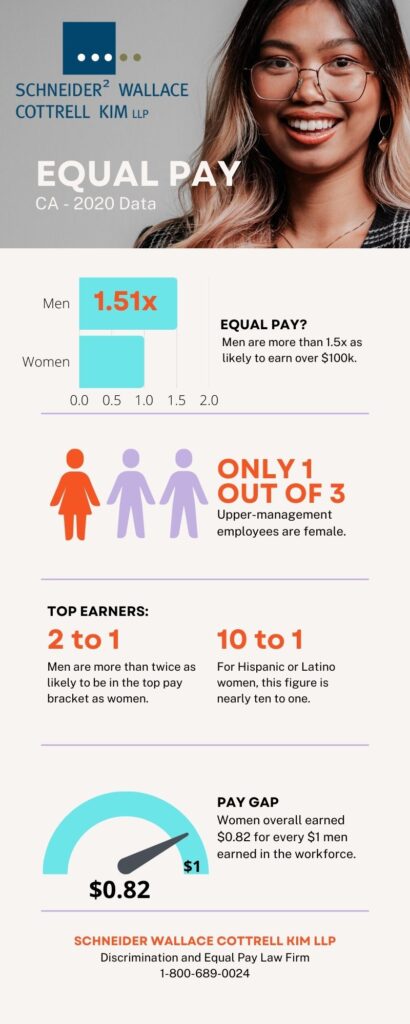

Our analysis reveals a concern for women’s pay in California and the nation:

Women are less likely to be promoted to management, but much more likely to hold job titles associated with illegal misclassification if promoted to manager.

Unequal Earnings in California

While we could not pair pay data with the LinkedIn job title and gender data, we can use other data to investigate pay bands.

California requires large employers (over 100) with workers in California to report pay yearly, including providing data on job titles, industry, metro area, gender and ethnicity. California then shares this data as a public record by industry, worker demographics, and metro area. The latest year of data available is 2020, with 2021 data likely available soon.

From the data we discovered these pay gaps:

- Men were 1.5 times as likely to earn $100,000 a year or more.

- Men were 2 times as likely to be in the top wage bracket.

- Men were 10 times as likely to be in the top wage bracket as Hispanic or Latino women.

- Upper management roles were one-third women, two-thirds men.

- Women earned $0.82 cents on dollar compared to men.

Women in California were 49% of workers not listed in management or executive roles, but only 43% and 34% of workers in management and executive roles. Large employers in California would need to promote 50,000 to bring parity to management roles.

When combined with our analysis of LinkedIn data above, a picture starts to emerge of potential equal pay issues involving women managers. Women are less likely to be made management and executives, but much more likely to hold job titles associated with illegal misclassification if promoted to manager.

Women in California – Equal Pay

Women made up only 37.7% of those earning 100k or more (cutoff of $101,920 and above), according to data submitted by large employers to California for 2020.

In none of the 25 metro areas broken down in California data were women as prevalent as higher earnings as men at the top bracket, however three metro areas did report women having more six figure earnings: Madera (55%), Modesto (54%) and Santa Cruz – Watsonville (53%).

Women and men, California 2020, earnings by pay band:

|

California 2020, Statewide |

All Employed |

Men |

Women |

Women % |

|

$208,000 and over |

502,811 |

352,082 |

150,729 |

30.0% |

|

$163,800 – $207,999 |

260,561 |

160,836 |

99,725 |

38.3% |

|

$128,960 – $163,799 |

348,842 |

201,228 |

147,614 |

42.3% |

|

$101,920 – $128,959 |

386,122 |

219,320 |

166,802 |

43.2% |

|

$80,080 – $101,919 |

456,605 |

256,882 |

199,723 |

43.7% |

|

$62,920 – $80,079 |

502,460 |

278,397 |

224,063 |

44.6% |

|

$49,920 – $62,919 |

500,621 |

271,073 |

229,548 |

45.9% |

|

$39,000 – $49,919 |

522,873 |

265,529 |

257,344 |

49.2% |

|

$30,680 – $38,999 |

507,591 |

242,097 |

265,494 |

52.3% |

|

$24,440 – $30,679 |

398,018 |

181,047 |

216,971 |

54.5% |

|

$19,240 – $24,439 |

304,063 |

139,267 |

164,796 |

54.2% |

|

$19,239 and under |

1,657,059 |

745,145 |

911,914 |

55.0% |

Women were 3 out of 10 earners in the highest bracket, rising consistently to 55% of the lowest pay bracket, those earning $19,239 or below.

Women made up 40% percent of the workforce earning above the threshold for exemption from overtime in California in 2020. Again, this is below the 58% seen for women with managerial job titles associated with improper denial of overtime and wages. When women are promoted, they are promoted to first tier management and likely improperly denied overtime at rates higher than men.

Equal Pay Lawsuits in California

Denial of overtime for workers who are not eligible to be exempt, regardless of gender, is not allowed if in violation of either the federal FLSA or California labor law. There are also multiple categories of benefits and pay that can be given unequally to employees by sex, including:

- Compensation including income not called wages or salary, but other terms such as: profit sharing, expense account, monthly minimum, bonus, commission, hotel accommodations, use of company car, or other.

- Stock options

- Vacation or holiday pay

- Leave, including family leave

- Retirement benefits

- Medical and Life insurance

Pay secrecy is a persistent contributor to the gender wage gap. Women cannot challenge wage discrimination if they do not know it exists. It is illegal to prohibit employees in California and some other states from disclosing his/her own wages, discussing the wages of others, inquiring about another employee’s wages, or aiding or encouraging another employee to pursue a claim for wage discrimination.

Pay discrepancy is allowed with the proper justification, which previously was wide but has been narrowed by recent laws. In California, the employer must show unequal pay was based on the following:

- A merit system

- A seniority system

- A system that measures earnings by quantity or quality of production

- A bona fide factor other than sex, race, ethnicity, or other excluded category, such as experience or education.

The employer must further prove that whatever factor(s) it relied upon to justify the unequal pay, the factor was applied reasonably and accounts for the entire difference in pay. In California, it is NOT allowed to use the prior earnings of an employee to justify an unequal salary today. This was removed to avoid the ongoing tactic of paying women less because they had earned less than men earlier in their career.

If you feel you may be misclassified, if women in your workforce are being treated differently in pay, promotion, or benefits, please contact us for a free and private legal consultation. Please contact us at 1-800-689-0024 or by email at info@schneiderwallace.com.

You have up to two years from the date of the violation, or up to three years if the violation is willful under the California equal pay laws. Consider a private legal consultation with a Schneider Wallace equal pay attorney.

Misclassification and Wage Theft: What You Can Do

If you’ve been given a managerial-sounding title like “assistant manager,” “supervisor,” “team lead,” or “coordinator,” but spend most of your time doing the same tasks as hourly workers—stocking, cashiering, cleaning, greeting customers, or following strict checklists—your job may not meet the legal standards for overtime exemption under federal or state law.

Misclassification is a widespread form of wage theft. It allows employers to avoid paying legally required overtime by assigning inflated job titles that don’t reflect the actual work performed. This tactic is especially common in frontline industries like retail, food service, hospitality, and janitorial work—and our data shows it may disproportionately affect women in some job titles, but is not legal regardless.

Here’s what misclassification often looks like:

- You’re salaried but rarely supervise others or make independent decisions.

- You work more than 40 hours per week (or 8 hours per day in California) with no overtime pay.

- You perform manual or routine tasks instead of strategic, managerial, or executive duties.

- You were promoted in title only—with no real change in authority or compensation.

If this sounds familiar, you may be entitled to:

- Back pay for unpaid overtime

- Additional penalties or bonus payments under state law

- Reclassification and protection from future wage violations

Federal law (the FLSA) and state laws like California’s wage orders and Labor Code provide strong protections against misclassification. Legal actions can result in significant financial recovery for employees.

Get Help. Protect Your Rights.

If you believe you may have been misclassified—especially if you are working in one of the industries or job titles highlighted in this report—contact us. We offer free and confidential consultations, and our legal team is experienced in representing workers in wage theft and misclassification cases.

Call us at 1-800-689-0024

Email us at info@schneiderwallace.com

We are here to help you understand your rights and pursue the pay you’ve earned. Don’t wait—there are time limits to file your claim.