Media

California Large Employers Wage Pay Reports Due, Results From 2020 Equal Pay Data

California expanded pay-data reporting requirements for large private employers. Employers with 100 employees, of which any are in California, are subject to EEO-1 reporting obligations under federal law but could satisfy California requirements by submitting their federal EEO-1 report. The EEO-1 included pay data by job category, sex, race, and ethnicity.

California Senate Bill 1162, passed in 2022, amended California Government Code § 12999 and introduced additional categories to report. Employers can no longer simply submit an EEO-1 report to the California Civil Rights Division (CRD).

The new pay-data report requirements are similar as they include reporting the number of employees by race, ethnicity, and sex across various job categories and pay bands. However, California now requires employers to list the average and median hourly rate for each combination of race, ethnicity, and sex. This data is similar to the pay bands based on metro area, job category, race, and sex that is available from the government summarizing these results across the state. 2021 data was submitted in 2022 to California, but the government website does not yet list the results.

2022 California Equal Pay Data

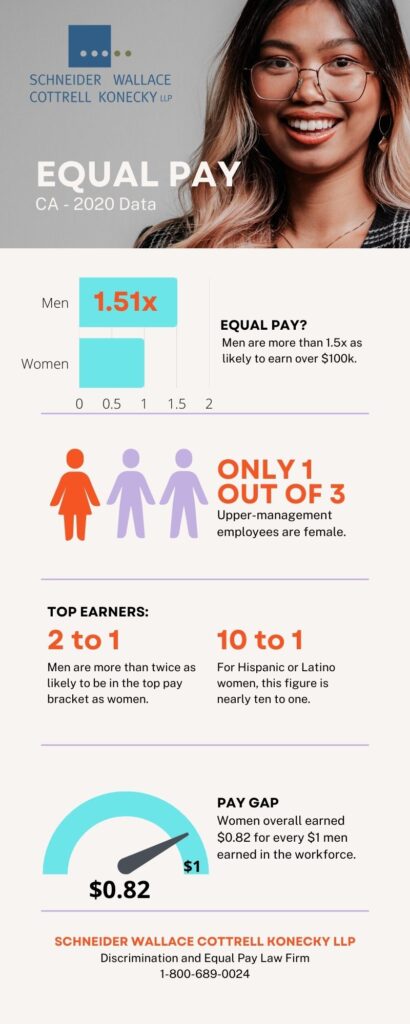

Reviewing the available 2020 data, Schneider Wallace discovered these pay disparities between men and women at large California employers:

- Men were 1.5 times as likely to earn $100,000 a year or more.

- Men were 2 times as likely to be in the top wage bracket.

- Men were 10 times as likely to be in the top wage bracket as Hispanic or Latino women.

- Upper management roles were one-third women, two-thirds men.

- Women earned $0.82 cents on dollar compared to men.

California Pay Reports- Due May 10, 2023

The next pay data report is due on May 10, 2023, and subsequent reports are due on the second Wednesday of May each year. Employers who do not report pay and pay bands as required may face court orders to comply, be liable for associated costs, and incur fines.

California Requires Job Posts to Include a Salary Range as of January 1st, 2023

Since 2018, California has required employers to provide the pay scale for a position when requested by an applicant that has completed an initial interview. As of January 1, 2023, California employers must offer pay ranges in the post itself.

Senate Bill 1162’s amendments to Labor Code § 432.3:

- Employers with 15 or more employees must include the pay scale for the position in any job postings that can be filled by a California resident, whether posted by the employer or by a third party.

- All employers (regardless of size) must provide the pay scale of the position in which a current employee is employed, upon request.

All employers (regardless of size) must keep records of California employee job titles and wages for three years after their employment ends. This data may be inspected by the Labor Commissioner regarding patterns of wage discrepancy and discrimination. If an employer fails to keep such records, a presumption can be made in favor of an employee’s unequal wage claim. The term “pay scale” is defined to mean the salary or hourly wage range that the employer reasonably expects to pay for the position. California employers not complying with these requirements face civil penalty ranging from $100 to $10,000 per violation. For the first violation, there is an opportunity to cure the deficiency to avoid a penalty.

California Fair Pay Law Firm

If you believe you have been discriminated at work, including receiving reduced pay, on the basis of race, sex, or other category, please contact an employment attorney to discuss. Schneider Wallace is an experienced employment law firm representing Californian’s who were not paid fully or fairly.

You can file a claim within two years from the date of the violation, or within three years if the violation is willful. For purposes of calculating the deadline, each paycheck in which you received unequal pay is considered a violation, including your last paycheck. If you believe you are being paid less than another employee of the opposite sex or different race or ethnicity, contact our experienced employment attorneys to receive a free consultation at 1-800-689-0024.

For more information on California equal pay laws, visit our page here.