Media

BlockFi Agrees to $100 Million Settlement with SEC and 32 States for Unregistered Crypto Loans

On February 14th, 2022, the Security and Exchange Commission (SEC) revealed BlockFi had agreed to a $100 million settlement for failing to register their crypto lending products and for violations of the Investment Company Act of 1940 and Securities Act of 1933. BlockFi agreed to a $50 million payment to the SEC, and an additional $50 million to be paid to 32 states for a total of $100 million. BlockFi also agreed to stop offering their products until they comply with long-standing securities law.

BlockFi Crypto Lending Offers Are Securities

The order details how the SEC views BlockFi Interest Accounts (BIA’s) as unregistered securities:

BlockFi promised BIA investors a variable interest rate, determined by BlockFi on a periodic basis, in exchange for crypto assets loaned by the investors, who could demand that BlockFi return their loaned assets at any time. BlockFi thus borrowed the crypto assets in exchange for a promise to repay with interest. Investors in the BIAs had a reasonable expectation of obtaining a future profit from BlockFi’s efforts in managing the BIAs based on BlockFi’s statements about how it would generate the yield to pay BIA investors interest. Investors also had a reasonable expectation that BlockFi would use the invested crypto assets in BlockFi’s lending and principal investing activity, and that investors would share profits in the form of interest payments resulting from BlockFi’s efforts.

The SEC further concluded that BlockFi had clearly marketed the products as investments, without the registration with the SEC that is required to do so, violating Sections 5(a) and 5(c) of the Securities Act.

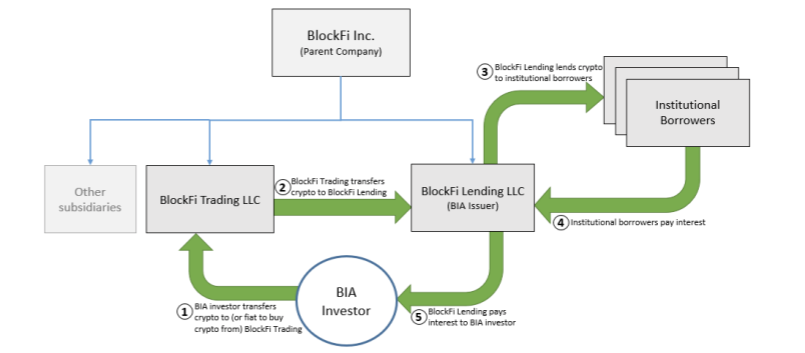

BlockFi Interest Account Structure

Investors opening BlockFi accounts funded the account in one of two ways: they transferred crypto assets to BlockFi wallets assigned to each investor, or they purchased crypto assets directly from BlockFi and then loaned them back to BlockFi. BlockFi transferred the crypto assets to their BlockFi Lending LLC, before the LLC lent the assets out to institutional borrowers:

In addition to crypto assets being loaded to borrowers, BIA investors could also borrow against the assets in dollars at the same time. BlockFI regularly adjusted the rates being paid for different crypto currencies, stating that they adjustments were based on “the yield that [BlockFi] can generate from lending”. BlockFi promoted the profits investors could earn from lending crypto assets through their accounts, declaring “an industry-leading 6.2%”, “as a way to bolster their returns”, and that BlockFi products were “an easy way for crypto investors to earn bitcoin as they HODL”.

During the periods BlockFi made these claims it had not registered with the SEC for its lending program.

BlockFi Misleading Statements About Risk and Collateral

The order details how BlockFi made allegedly misleading or false statements between March 2019 and August 2021. Specifically, the SEC claims BlockFi made materially false claims understating the risk associated with BlockFi Interest Accounts, violating Sections 17(a)(2) and 17(a)(3) of the Securities Act.

BlockFi made statements that loans were “typically” over-collateralized when, allegedly, in reality only 16-24% of loans were over-collateralized from 2019 through 2021. BlockFi repeatedly overstated to investors the protections from institutional borrower default.

Failing to update disclosures to accurately reflect collateral and risk left investors without complete and accurate information to evaluate the risks of BLockFi Interest Accounts. BlockFi accounts in default would not have been able to pay the stated interest owed, nor returned the underlying assets. Investors were not fully aware of the risk of these defaults.

BlockFi to Register Under the Securities Act

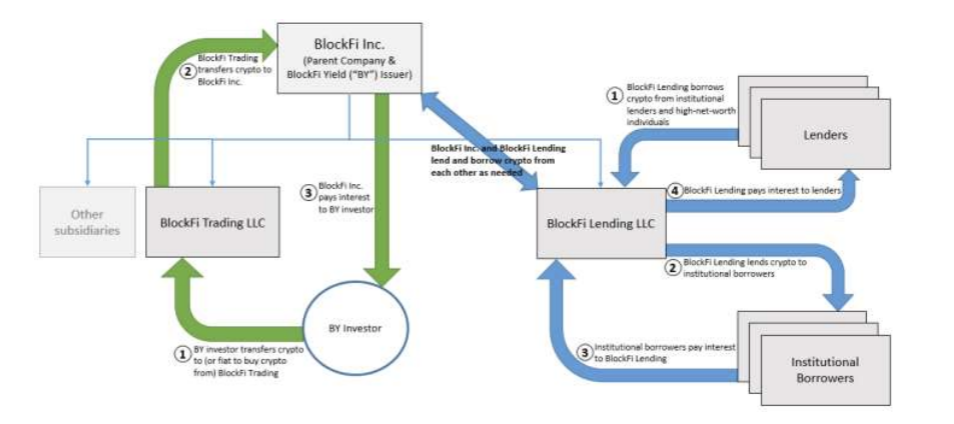

BlockFi has stated publicly they intend to begin complying with the law and register their products, prior to offering them again in the United States. The SEC outlined the proposed future BLockFi Yield investment product:

In this scenario, investors buy or transfer cryptocurrency to a BlockFi Trading LLC, as previously. Crypto assets are transferred to BlockFi Inc, the parent company. The parent company will transfer assets to BlockFi Lending LLC and borrow crypto back as needed. The Lending LLC will additionally borrow from other institutional lenders, pay interest to lenders, while loaning crypto to institutional borrowers who pay interest.

BlockFi Payment Schedule

BlockFi will make 5 payments of $10 million to the United States Treasury to satisfy the half of the $100 million owed to the US government. BlockFi will pay $10m within two weeks of the order entry and make 4 additional payments of $10 million each half year for the next 2 years.