Media

Department of Labor Collects $164,607,324 in FLSA Back Wages for Workers During Fiscal Year 2021

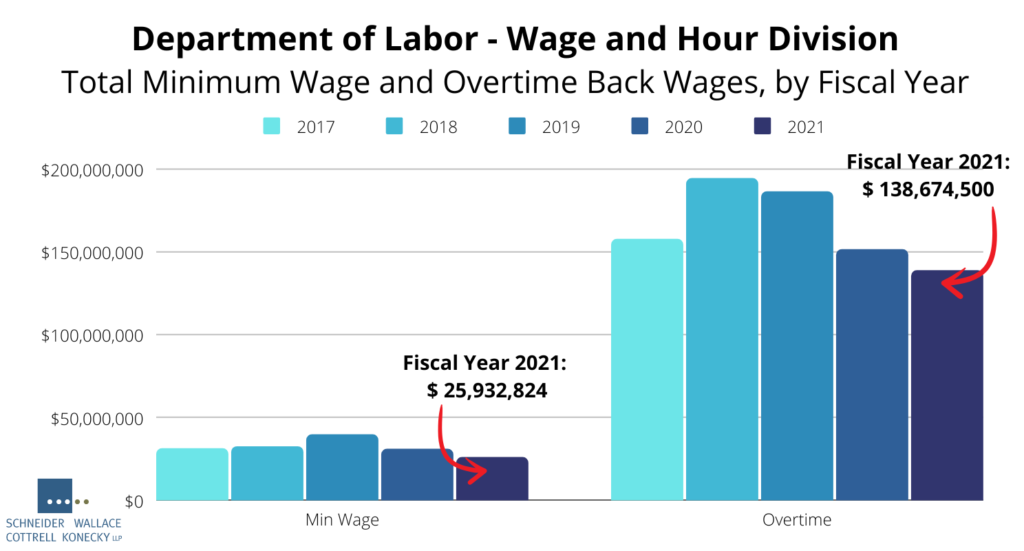

The United States Department of Labor, Wage and Hour Division, reported a total of $164.6 million in back wages collected for workers during fiscal year 2021 from two categories: $138,674,500 collected for unpaid overtime, and $25,932,824 collected for failure to pay minimum wage. Both the minimum wage violations and overtime violations are for companies and individuals who violated the Federal Fair Labor Standards Act (FLSA).

The Fair Labor Standards Act

The Fair Labor Standards Act (FLSA) allows the United States Department of Labor (DOL), or any employee or their legal representative, to recover back wages and an equal amount of liquidated damages anywhere minimum wage or overtime violations exist. In some cases, the statute of limitations allows for recovery on violations that occurred up to two years from the date of the violation. Where the violation was willful violation a 3-year statute of limitations may apply.

States such as California and others provide additional protections. The US Department of Labor, and their Wage and Hour Division, enforce the federal laws.

Minimum Wage Violations

Covered, nonexempt workers are entitled to a minimum wage of $7.25 per hour effective July 24, 2009. Many states, counties, or cities have separate higher minimum wage requirements. The Wage and Hour Division of the DOL enforces violations of the federal minimum wage.

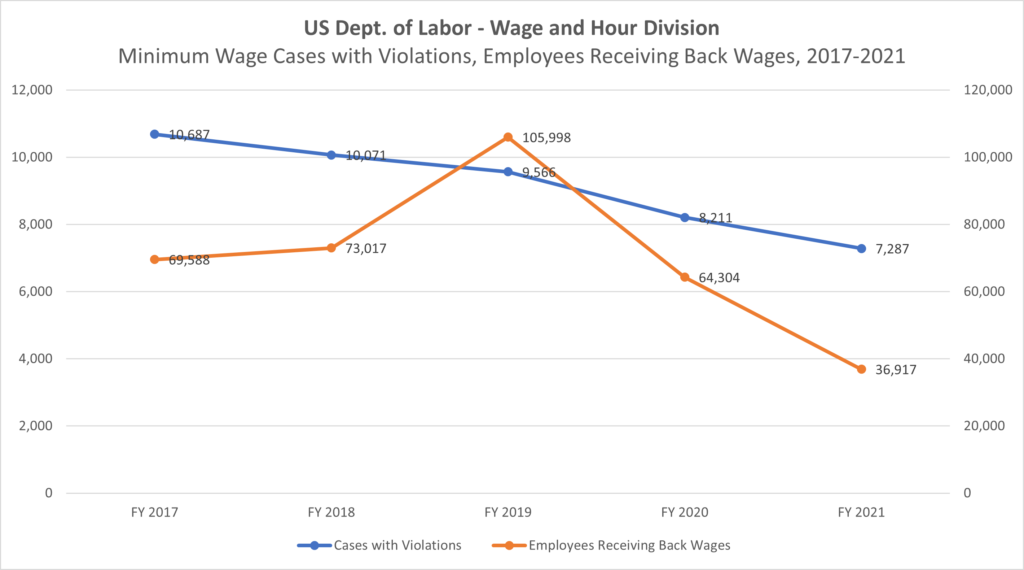

For fiscal year 2021, the DOL reported 7,287 cases of minimum wage violations. The DOL was able to recover $25,932,824 in total for these violations, resulting in a per case average of $3,559.

The Department of Labor reported that a total of 36,917 workers received back wages, for an average back wage of $702. The number of workers receiving pay was a significant drop from prior years, however the amount each worker received increased.

A 5 year retrospective of DOL minimum wage cases with violations, and total workers receiving back wages:

Workers who allege a violation of minimum wage laws often work with private attorneys who represent them in seeking a full recovery plus liquidated damages. To speak with an employment attorney, contact the law firm of Schneider Wallace at 1-800-689-0024, or reach us at info@schneiderwallace.com.

Unpaid Overtime Violations

The Fair Labor Standards Act sets overtime pay at one and half the employee’s regular pay, for any hours worked in a week that exceed 40 hours. While exempt employees such as managers are generally ineligible for overtime pay, employers may label an employee exempt who does not qualify, causing unpaid overtime, a common form of wage theft.

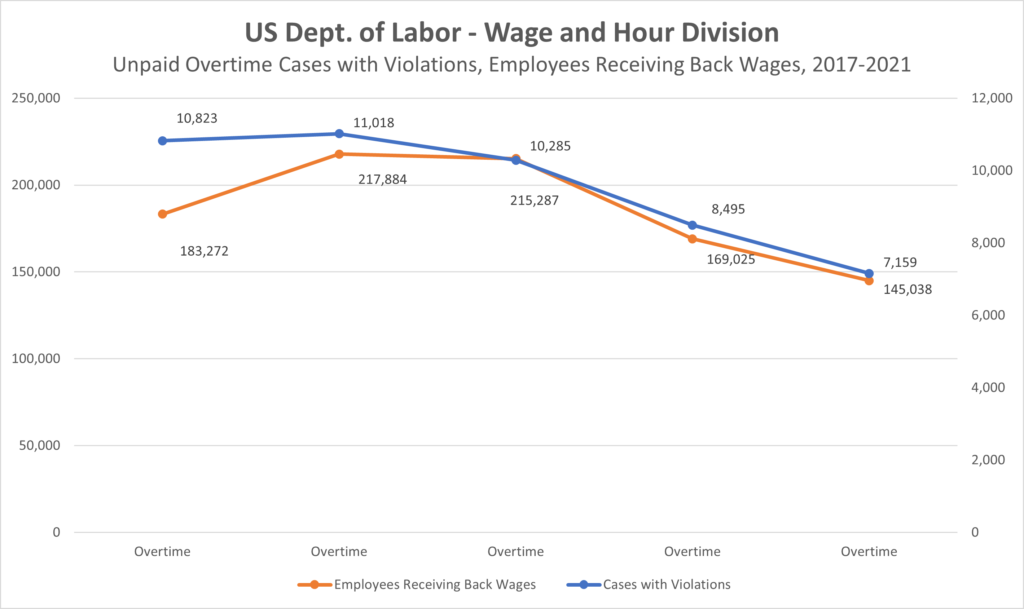

In Fiscal Year 2021, the DOL reported a total of 7,159 cases with violations. The DOL reported $138,674,500 in back wages recovered for 145,038 workers. This is a per violation average of $19,370.65, and a per employee wage recovery of $956.13.

A 5 year review of the number of FLSA overtime violations and workers receiving back wages:

Wage and Hour Attorney

If you believe you are not being paid for all the time you have worked, or are not being paid overtime due to you, we invite you to schedule a consultation with an employment law attorney in our Northern California, Southern California, Texas, North Carolina or Puerto Rico offices.

Schneider Wallace Cottrell Konecky LLP is a national law firm that represents employees in a wide range of employment law cases, including class action lawsuits involving the failure to pay wages, overtime pay and commissions. Contact us at or 1-800-689-0024.